The Cotton boll Laundromat

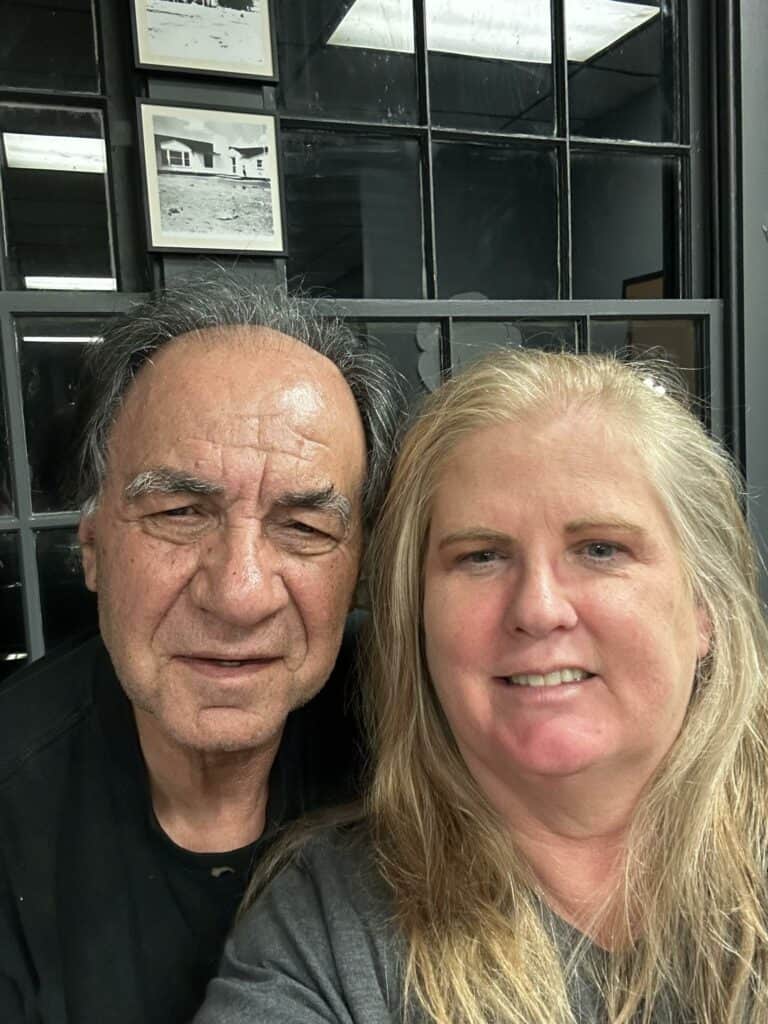

Owned and operated by John and Kim Parker

Self-service laundromat serving the O’Donnell community.

What we offer

8 washers and 4 dryers in a clean, comfortable, and safe environment.

Convenience: Free WiFi and a temperature-controlled building for year-round comfort.

Essentials: Laundry detergent, fabric softener, and dryer sheets available for purchase.

Refreshments: Water, soft drinks, and snacks available now, with a coffee bar coming soon!

Open 7 days a week from 10am – 8pm

Coming Soon:

Drop-Off Service: Wash, dry, and fold service for those who prefer to leave the laundry to us.

Pricing:

Wash machines: $1.75 (run 29-37 minutes)

Dryers: $1.00 (holds two loads or one comforter, runs 45 minutes)

Why O’Donnell?

John and Kim fell in love with O’Donnell’s hospitality and tight-knit community, choosing it as their “forever home” in 2013. After years of public service, including Kim’s tenure as Mayor, they’re excited to bring a much-needed business to town.

A Laundromat with a History

The Cottonboll Laundromat, named in honor of O’Donnell’s cotton farming heritage, has been completely remodeled with brand new machines. The front windows, however, hold a special piece of local history—they once belonged to the farmhouse of Darla Stidham’s grandparents.

More Than Just Laundry

John and Kim want the Cottonboll Laundromat to be more than just a place to do laundry. They hope it becomes a gathering spot where friends and neighbors can enjoy a refreshing drink, a snack, and good conversation.

So whether you have a load of laundry or just need a break, stop by and say hello!

Contact

Address: 813 Doak St, O’Donnell TX 79351

Phone number: 806-589-8647

Email: [email protected]

Kal Luke’s Corner

This kids area is dedicated to Kal Luke.

So why are we dedicating this to Kale?

Well it is simple really, this special little cowboy is such an inspiration of courage, strength, and has the perseverance to overcome anything thrown his way.

Through his journey and power of prayer he has been a bright light in many lives in our small community and has moved people towards a greater faith including our own.